|

PARISH COUNCIL Finances

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

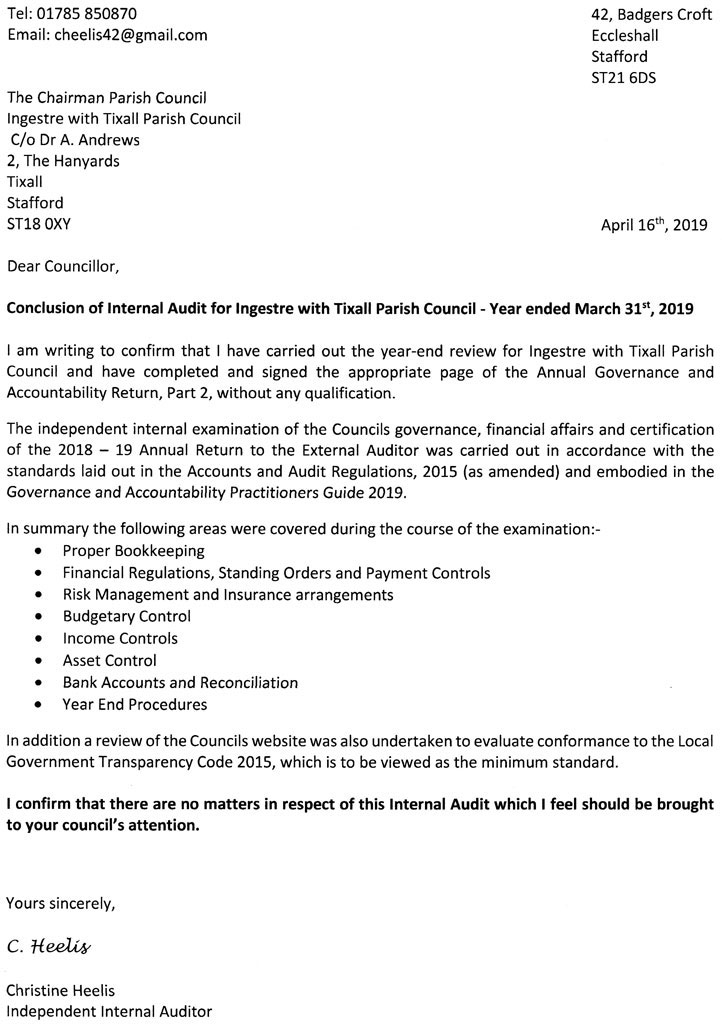

Note previous Auditors have asked

us to point out that we receive separate precepts

for Ingestre (£2000) and Tixall (£2000) Item 2,

although we have joint accounts. Previous Auditors have also

commented on our high reserves.

As a Councillor, I am an unpaid Clerk. We

have therefore set aside a reserve of £2500 to pay

for a Clerk, including National Insurance and

Pension contributions when this becomes necessary in

the future. In addition it is likely to be necessary

to pay for a Laptop and website editing program for

the Clerk which are currently provided free by me.

We also have an election reserve to spread

the cost of elections over several years, this is

currently £1200 with Parish Council elections this

May. We have been told that contested elections are

likely to cost at least £1000 in each parish.

We have also decided that rather than

purchase a mower for the Home Farm Land, with

associated labour, insurance and maintenance costs,

we would use the residue of the Home Farm Land

moneys to pay for a man to mow the grass. Last year

he mowed 3 times at a total cost of £350. Variances: Box

No.

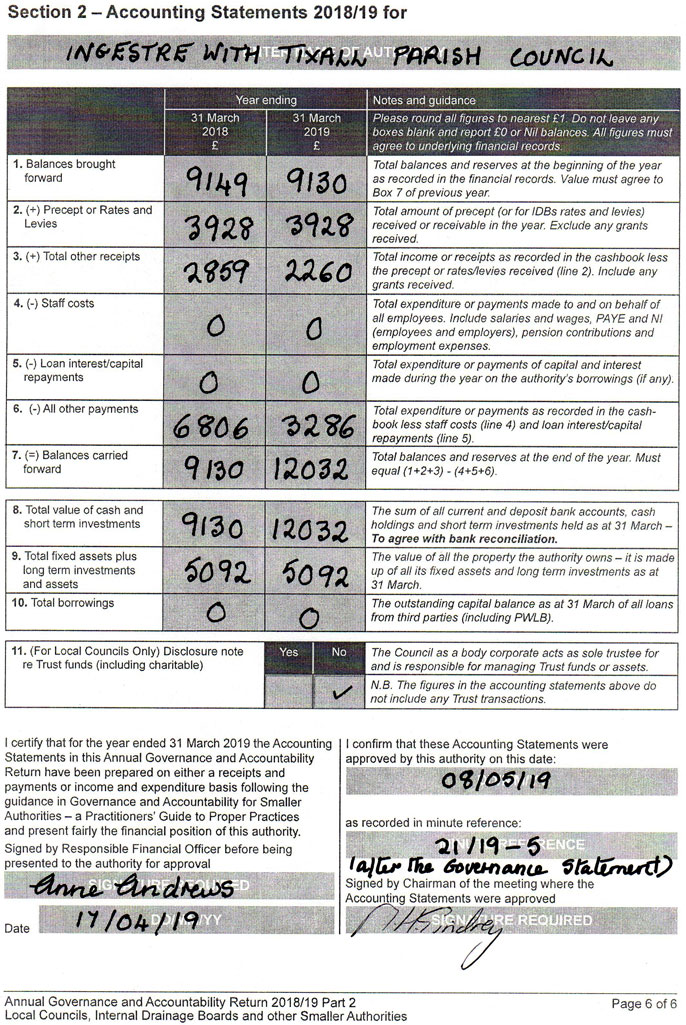

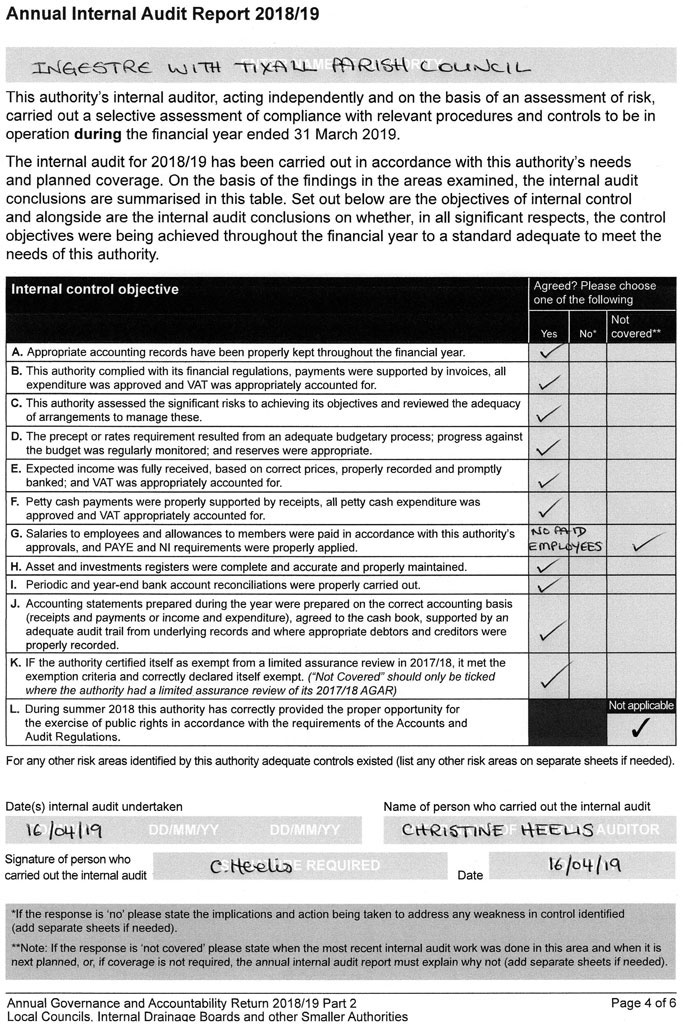

1. Balances brought forward Figure

in

2019 column

£9130 Figure

in

2018 column

£9149 Total

Variance

= £9149 - £9130 = -£19 This

is not significant Box

No.

2. Precept less Government Grant Figure

in

2019 column

£3928 Figure

in

2018 column

£3928

No change Box

No.

3. Total Other Receipts Figure

in

2019 column

£2260 Figure

in

2018 column

£2859 Total

Variance

= £2859 - £2260 = £599 599/2859

x

100 = 20.95% Reason: 1. 2018

figure includes £500 donated by HS2 Local Action

Group towards Consultants Fees

Variance less this = £599 - £500 = £99

£99/2859 x 100 = 3.5% Box

No.

6. All Other Payments Figure

in

2019 column

£3286 Figure

in

2018 column

£6806 Total

Variance

= £6806 - £3286 = £3520 £3520/6806

x

100 = 51.72% Reason: 1. 2018

figure includes £1196 spent on Home Farm Land

Project and £1450 spent on an Environmental

Consultant re HS2

Variance less this = £3520 - 1196 - 1450 =

£874

£874/6806 x 100 = 12.84% Box

No.

7 & 8. Balances carried forward & Total

value of Cash and Short term Investments Figure

in

2019 column

£12032 Figure

in

2018 column

£9130 Total

Variance

= £12032 - £9130 = £2902

Reason: 1. 2018

figure includes £1196 spent on Home Farm Land

Project and £1450 spent on an Environmental

Consultant re HS2

Variance less this = £2902 - 1196 - 1450 =

£256

£256/9130 x 100 = 2.80% Box

No.

9. Fixed Assets Figure

in

2018 column

£5092 Figure

in

2017 column

£5092 No

change

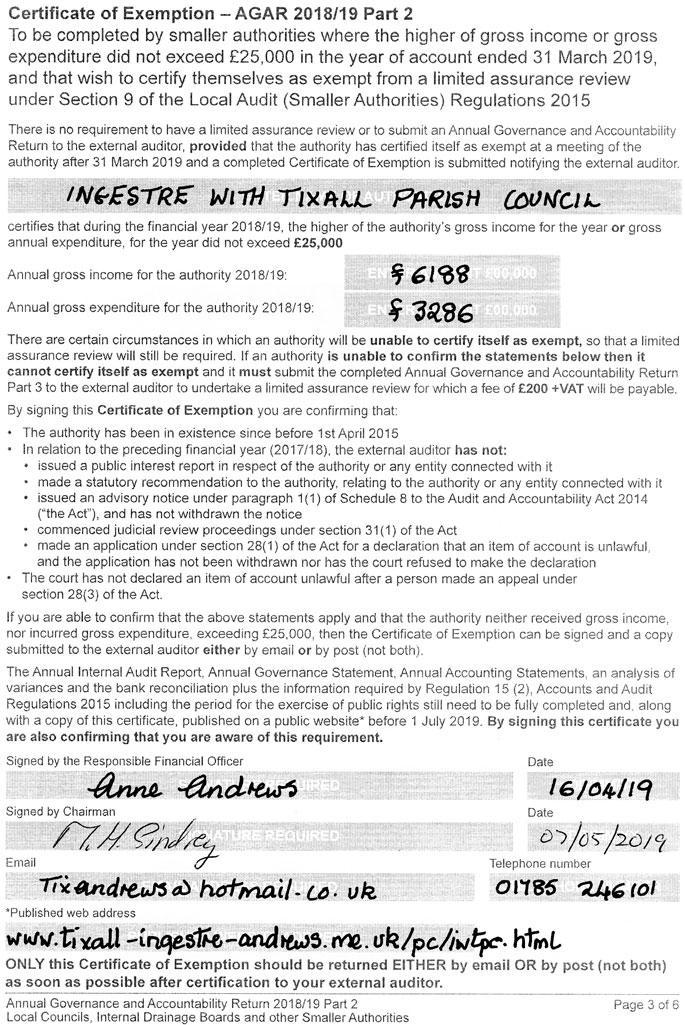

BANK RECONCILIATION 31st

March 2019 Ingestre

with Tixall Parish Council Prepared by Dr

A. Andrews Parish Clerk and responsible Finance

Officer

4.4.2019 Approved by Mr

M.Sindrey Chairman

................. Balance per Bank

Statements at 31st March 2019 Barclays Bank

Account

.. £8541.72

NS&I Investment

Account

.

£3593.32 Less uncashed

cheque..............................................

-£153 Petty Cash Float ....................................................... £50

No unbanked Cash

TOTAL carried forward to 2019/20

£12,032.04 The net balances

reconcile to the Cash Book for the year as

follows: CASH BOOK

(Receipts & Payments)

Opening

Balance................................... £9130

Add: Receipts in the

year...................... £6188

Less Payments in

Year............................£3286 CLOSING BALANCE PER CASH

BOOK @ 31 MARCH 2019

£12032

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||